Online Mutual Fund Calculator

Investing in a systematic manner with best balanced mutual funds is a good approach to maximize wealth.

What is Balanced Fund?

Balanced funds or hybrid funds are those categories of mutual funds that invests their corpus in a mix of debt and equity. These are suitable for those investors who want to take exposure in equity and debt at the same time.

Advantages of Investing in Balanced Funds

- Well diversified and balanced portfolio

- Moderate risk

- Moderate volatility

- Suitable for moderate investors

SEBI has categorized hybrid funds into six broad categories:-

Aggressive Hybrid Funds

Aggressive Hybrid FundsThese funds are mandated to invest between 65%-80% of their assets in equity and equity-related instruments while the investment in debt related instruments should be between 20%-30% of the total assets. These are suitable for those investors who are willing to take some risk as these schemes invest predominantly in equity.

Balanced Hybrid Funds

These funds are mandated to invest between 40%-60% of their assets in equity and equity-related instruments while the investment in debt related instruments should be between 40%-60% of the total assets. These are suitable for moderate investors as these schemes invest in a mix of debt and equity in almost equal proportion.

Conservative Hybrid Funds

These are the funds for conservative investors who are looking for steady but slightly higher returns than a pure debt fund. The fund manager invests 75%-90% of the total assets primarily in debt instruments, while on the other hand they are mandated to invest 10%-25% of the assets in equity instruments.

Dynamic Asset Allocation or Balanced Advantage

These funds are managed dynamically by the fund manager. The holding in debt and equity may vary between 0%-100% respectively based on the call of the fund manager. Some fund managers adopt Price to Equity-based model while some adopt Price to Book value model.

Multi-Asset Allocation

These are the open-ended schemes which have to invest in at least three asset classes with a minimum exposure of 10% in each of the asset classes. These asset classes could be equity, debt, or gold.

Equity Savings Funds

These funds invest at least 65% of their total assets in equity and equity-related instruments while investing a minimum of 10% of the assets in debt. These schemes also allocate some assets towards the arbitrage strategy.

Arbitrage Fund

These funds generally follow some arbitrage strategy by maintaining a minimum exposure of 65% to equity and equity-related instruments.

Are balanced funds a good investment?

Yes, balanced funds can be a good investment option for moderate investors who want to have simultaneous exposure in multiple asset classes. However one should choose funds based on his risk appetite and time horizon.

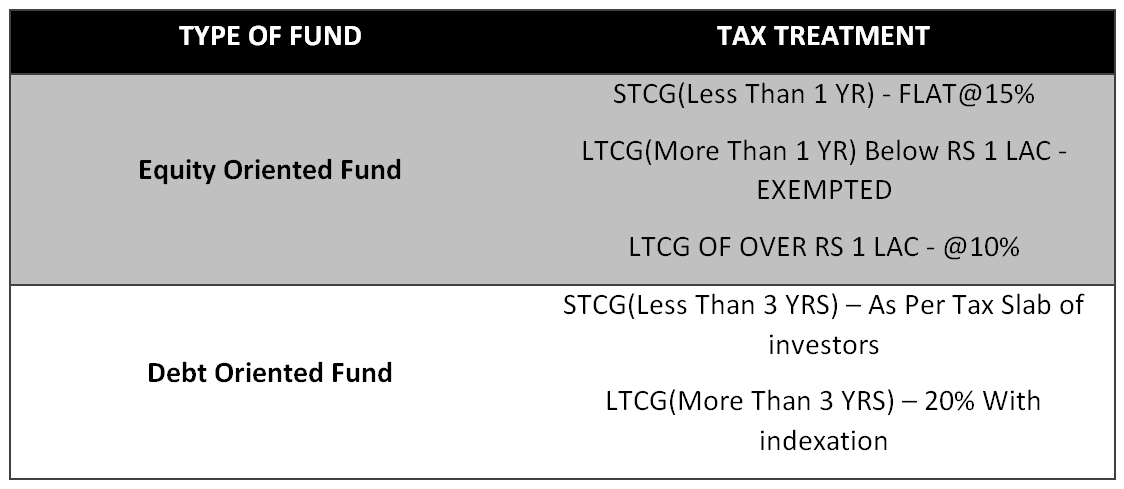

Capital gains from all the mutual funds whether it is debt or equity are taxable. The fund should have minimum exposure of 65% in equity and equity-related instruments in order to be treated as equity funds for tax purposes.

Is it the right time to invest in a balanced fund?

Well, there is as such no perfect time for making investments in equity or debt. No one can predict the markets and hence one can make investments when one has surplus funds and wants to invest in achieving his financial goals.

Further Reading: